Increased trust in Asian markets, greater consumption of goods, and new trade agreements have led to greater investment – particularly in Southeast Asia – resulting in an expansion of the region’s logistics sector.

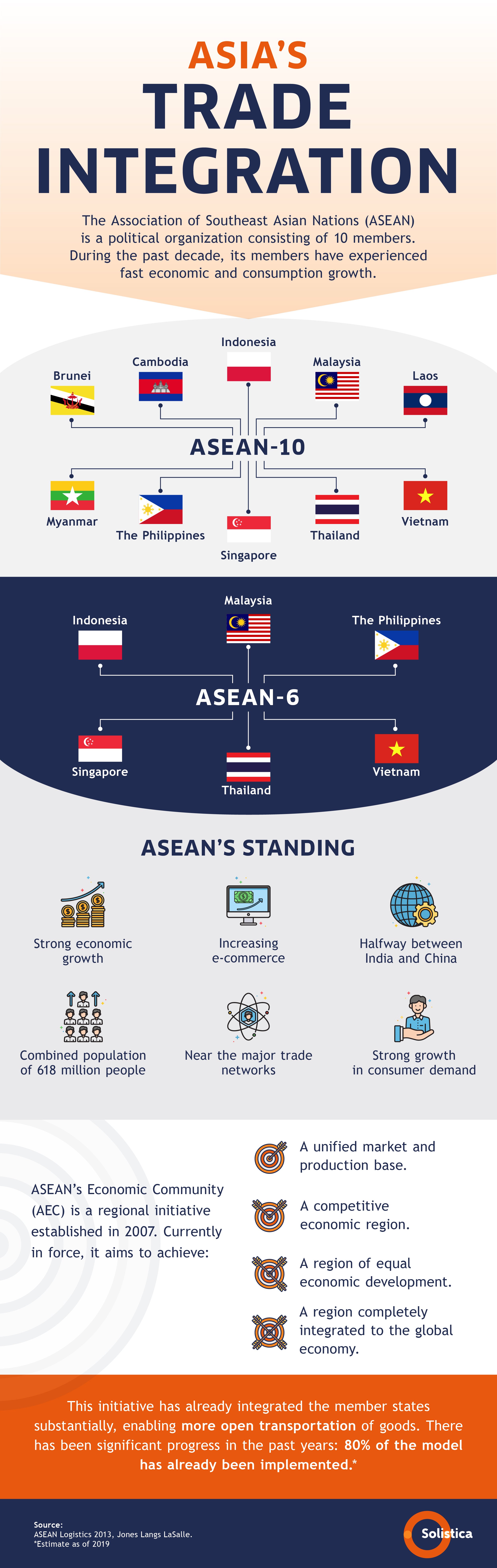

The political tensions between China and other countries and the rise in production costs have forced some companies to look for investment opportunities in Southeast Asia, mainly in any of the five members of ASEAN (Association of Southeast Asian Nations): Thailand, Indonesia, Malaysia, Singapore, and the Philippines, which – thanks to their growing middle class and economic openness have become a major trade zone facing the challenge of making their supply chain more efficient as it grows increasingly more complex.

According to investment management firm Jones Lang LaSalle’s report Discovering the growing wealth of ASEAN economies, trade in the region’s countries has grown exponentially in the past decade and volumes are forecast to grow by 130% by 2023, which will have a direct impact on the logistics throughout the whole continent. Trade volume will grow as per these factors:

- An increase in the demand for goods in India and China, arising from the growing middle class in both countries.

- Greater investment in infrastructure, which will let a greater number of goods go through the region, improving thus the supply chains of the countries neighboring China and India, positioning Malaysia and Singapore as global trade centers, and provide ASEAN countries with a more accessible network.

- A growing internal market which, in turn, will increase the demand of goods. Currently, 24% of ASEAN’s total trade is interregional, and is expected to grow significantly.

- Governments will open new trade routes and unloading systems.

The greatest impediment for maximizing the region’s volume is a lack of modern infrastructure; nevertheless, the plans currently in execution integrate the supply chain between countries better, enabling an effective transportation of merchandise.

China

During the last 30 years, China has become the manufacturing location for most companies due to the country’s cheap labor costs; however, one of its current goals is to compete in the production of innovative technologies, which will result in the construction of industrial parks and investment in logistics.

Asia’s Development Bank calculates an investment of 8.4 billion dollars will be required between 2016 and 2030 in the region’s transportation infrastructure; this has led to ambitious strategies such as the Belt and Road Initiative (BRI), which looks to rebuild the ancient Silk Road, creating a parallel sea route, and increase the global weight of China. This project was launched in 2013 and encompasses over 70 countries in Asia, the Middle East, Africa, and Europe, which have invested in ports, railroads, highways, and power plants, resulting in great opportunities for the logistics sector.

Developing Asian Countries

-

India:

The introduction of the GST, Goods and Services Tax, in 2017 has been hailed as the greatest tax reform in the country’s history; it substituted many taxes and achieved a uniformity that lends reliability to the market. Before, same products were sold at different prices according to state borders. In terms of logistics, this has eliminated checkpoints, lower inventory levels, and increased the number of warehouses.

-

Indonesia:

ASEAN’s largest economy. Despite the global economic conditions, Indonesia’s growth has remained stable for several years thanks to its high internal consumption and its low dependency on exports. The country could benefit from investing in infrastructure to facilitate trade and the professionalization of its unqualified labor force in some operations.

-

Malaysia:

Foreign investment and increased consumption are major growth drivers for this country. Its infrastructure, government’s policies, industrial zones, and tax privileges make the country attractive for foreign investors; nevertheless, corruption in the government can sometimes be a great obstacle.

-

Thailand:

After some natural catastrophes, the growth of almost 5% in 2017 came from foreign investment, manufacturing economy, and government subsidies for cars and rice. The fact Thailand owns strong infrastructure has made it an appealing alternative for investors. The country’s main challenge is its ever-changing political landscape and having its ports overloaded, which lowers its ability to compete with neighboring countries.

-

The Philippines:

Thanks to investments, a strong consumer market, and a growth in its construction sector, the country’ economy has grown between 6.5 and 6.7% in the past two years (2017 / 2018) according to the Philippines’ Secretary of Budget and Management, Benjamin Diokno. Despite this, the infrastructure for roads, seaports and airports has proven a challenge, prompting the partnership of government and companies. Corruption and territorial disputes are other major obstacles, as well as restrictions on private property.

-

Vietnam:

During the past years, Vietnam has experienced strong economic growth and an increase in exports. The fact it has a developing internal market has helped attract foreign and domestic investors. The country has also invested in infrastructure through public-private partnerships. One of the main obstacles are restrictions on property and the tensions with China over certain territories.

Logistics Infrastructure in Southeast Asia and main Trade Routes

Even though land transportation is the main connection between ASEAN countries, the existence of islands has driven the investment and usage of other means. Projects such as the Asian Highway Master Plan have built an effective road network throughout Southeast Asia, resulting in fewer bottlenecks and the restoration of roads.

-

Rail Transportation:

Even though the railroad network is currently underdeveloped, thanks to ASEAN plans have been approved to invest in the creation of a more integrated network, mainly in the sections connecting Southeast Asia with China.

-

Sea Transportation:

ASEAN understands sea routes are vital to achieve an efficient supply chain, this is the reason it wants to make the most of its strategic location through regional and global routes as well as capitalize on its advanced seaports infrastructure. The ports at Singapore and Malaysia are ideal to handle the great loads carried by the new ships used by the logistics sector.

-

Air Transportation:

The plan of air transportation in this zone amounts to 34 billion dollars and is expected to be finished by 2020. With almost 12 billion dollars in seven projects, Vietnam is the country with the greatest investment in this respect.

These are the main trade routes used by these means of transportation:

- South – North Route: This is the most important route, passing through Thailand, Malaysia, and Singapore. Other extensions of this route reach Indonesia by sea and air.

- East – West Route: This route can only be accessed by truck or plane; nevertheless, six railroad lines are under construction to connect Singapore and China through Vietnam, Laos, and Myanmar.

- China – ASEAN Route: Because China is currently ASEAN’s main trade partner, this route will continue being of the utmost importance.

- India – ASEAN Route: Since 2012, India and ASEAN countries have had a strong trade relationship totaling over 100 billion dollars a year.

ASEAN’s consumer market will continue being a decisive factor for trade and logistics throughout Asia. The trend in economic and population growth will continue and, just as in other markets, as retailers become omnichannel, the demand for logistics transportation and storage will rise.

Asia’s economic and political climate is increasingly more stable and provides new opportunities for the manufacturing sector. Free trade agreements and government policies will contribute to the creation of new means of transportation guaranteeing efficient supply chains across borders. There is no doubt that logistics will be one of sectors benefitting the most from this new infrastructure, promoted mainly by ASEAN.

If you wish to learn more about what is happening in our continent, we invite you to read our article: The Integration of Logistics in Latin America.